Financial moves to make before the end of the year

15 financial moves to make before the end of the year

It’s almost 2020… do you have a customized financial plan to help you reach your goals and dreams?

Although we can all think of more exciting ways to spend our time, in a world of lower returns, organizing our financial future will pay huge dividends in the long run. We recommend to use the calm before the year-end holiday busy season to make some smart money and tax moves.

The BFM checklist will keep you on track and bring you peace of mind.

Tax-planning is an important part of investing. Proper planning and strategies help you save money and accelerate wealth building to reach your goals.

The last two months of the year are often a mad rush so we thought that it is a good time to share the BFM checklist of important items to consider before the calendar year ends, all related to your investments and finances so that you can reach your goals and dreams faster.

Summary

1. Review your IRA - 401(k) / 403(b) retirement accounts - Are you on track for a comfortable retirement?

2. Start tax planning! It's not too early to think about taxes - Asset location & Tax efficiency

3. Rebalance your portfolio

4. Harvest your capital losses

5. Check your emergency fund

6. Review your insurance policies

7. Contribute to your Health Spending Account

8. Take your Required Minimum Distribution

9. Contribute to your 529 Plan

10. Determine your net worth

11. Check your credit score

12. Check your beneficiaries

13. Update your estate plan

14. Maximize your business deductions

15. Spending and automated savings - You want to look ahead

1. Review your IRA - 401(k) / 403(b) retirement accounts - Are you on track for a comfortable retirement?

You could increase the funding of your IRA and company retirement plan (401(k) or 403(b) accounts).

Returns generated in IRA and 401(k) / 403(b) accounts compound tax-free over their entire life. Investing in an IRA / 401(k) / 403(b) / HSA / 529 account in this PIMCO fund would have generated 162% in the last 15 years, but if you would have invested in the same fund in your brokerage account (taxable), the performance would only be 53%.

Avoid taking distributions prior to age 59½ otherwise a 10% early withdrawal penalty may apply.

401(k) and 403(b) accounts allow individuals younger than 50 to contribute $19,000 in 2019, and individuals 50 and older to contribute $25,000. Some plans allow workers to make additional contributions of after-tax money. For those under 50, the maximum is $56,000 (or $62,000 with catch-up). Taxes are deferred on any earnings that the after-tax money makes. Later, some people roll these contributions into a Roth IRA so the money would then grow tax-free.

Traditional and Roth IRAs allow individuals younger than 50 to contribute $6,000 each year and individuals 50 and older to contribute $7,000 each year. Even if you earn too much to contribute to a Roth IRA directly, it may be beneficial to you to open a traditional nondeductible IRA and convert it to a Roth; there is no income limit on traditional nondeductible IRAs or conversions.

Maybe it is time to roll over an old and expensive 401(k) to your IRA?

2. Start tax planning! It's not too early to think about taxes. Asset location & Tax efficiency

Review your taxable and non-taxable accounts to ensure they are optimized for tax efficiency.

Evaluate if you should delay purchasing mutual fund shares until 2020 to avoid taxes on brand new investments.

If you have foreign bank accounts, make sure you comply with FATCA and FBAR (forms FinCEN 114, 8938, 8621 for PFIC...). If you have forgotten, you may look into the Offshore Voluntary Disclosure Program (OVDP which ends September 28) or Streamlined procedures.

The federal income tax rates on long-term capital gains and qualified dividends are 0%, 15%, and 20%. High-income individuals can also be hit by the 3.8% NITT. It is still lower than the top regular tax rate of 37%. Holding on longer to your appreciated securities can lower your taxes. Owning them for at least one year and a day is necessary to qualify for the preferential long-term capital gains tax rates.

Selling the right shares may also lower your taxes. It may be beneficial to you to sell shares that have been held a year or less rather than those held longer. Selling recently purchased shares at little or no gain may be better than selling shares held for more than one year if that sale would produce a significant gain. In that case, you should notify your broker regarding the specific shares you want to be sold.

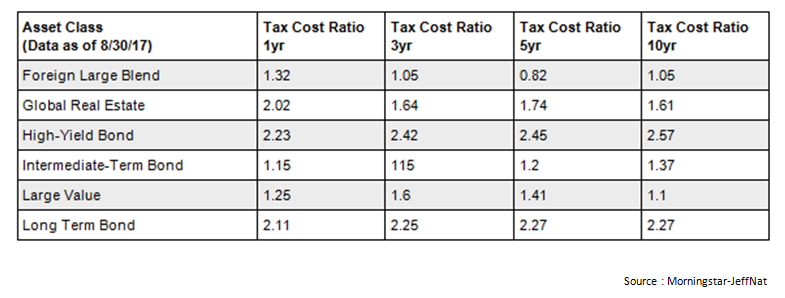

Morningstar estimates that approximately 1%-2% are lost annually to tax-inefficient investing. If a fund had a tax cost ratio of 1.5% for a three-year time period, it means that on average each year, investors in that fund lost 1.5% of their assets to taxes.

You can also invest in tax-free accounts or in tax-free securities.

3. Rebalance your portfolio

Make sure you have rebalanced your portfolios to keep them in line with your goals, time horizon and risk tolerance. The market movements may have thrown off your portfolio balance between stocks and bonds. US Stocks went up more than 400% since 2009.

David Swensen, the Chief Investment Officer at the Yale Endowment, in his book Unconventional Success: A Fundamental Approach to Personal Investment, performed an analysis that showed optimal rebalancing could add 0.4% to your annual return.

4. Harvest your capital losses

Maybe it is time to sell some funds, ETF, or stocks to generate some capital losses?

Tax-loss harvesting is a method of reducing your taxes by selling an investment that is trading at a significant loss.

Find out if you have any loss carryovers from prior years to be applied against capital gains (from sale of funds, ETF, stocks… in your taxable/brokerage accounts). If your current year’s capital losses exceed your capital gains, you have a net capital loss. You can use up to $3,000 of that loss to offset other taxable income such as your salaries, wages, interest and dividends. If the capital loss is more than $3,000, you can carry over the excess and apply it against capital gains next year.

5. Check your emergency fund

Don’t forget to establish or tune up your emergency fund. It is an account that is used to set aside funds to be used in an emergency, such as the loss of a job, an illness or a major expense. This is also a good time to set aside money for the next year's cash needs.

6. Review your insurance policies

Do you have a life, disability, long term care, or an umbrella insurance? Make sure you and your loved ones are well protected if something happens to you. Your life may have changed (birth, marriage…). If you do have enough coverage it is also a good time simply to review the different types of coverage you have.

7. Contribute to your Health Spending Account

Did you maximize your contribution to your healthcare HSA?

The interest and earnings in this account are tax free!

The maximum contribution for 2019 is $3,500 for an individual and $7,000 for a family ($1,000 catch-up over 55). The contributions are tax deductible and withdraws are non-taxable if they are used for medical expenses. Over the age of 65 you can withdraw funds with no tax (if the distribution is used for unreimbursed medical expenses so don't forget to keep your medical receipts starting today).

Fidelity estimates that a 65-year-old couple retiring will need $280,000 for health care costs in retirement, in addition to expenses covered by Medicare. The HSA can be a great source of tax-free money to pay those bills.

If you don't have an HSA, make sure that you have spent the entire balance in your Flexible Spending Account.

8. Take your Required Minimum Distribution

If you are age 70.5 or older, remember to take your required minimum distribution to avoid a potential 50% penalty.

9. Contribute to your 529 Plan

Did you contribute to your 529 educational plan?

You can contribute $15,000 per year (annual gift tax limit) per person and you can pre-fund in a single instance for up to five years’ worth of contributions, i.e. up to $75,000 (5 x $15,000). Together, that means a married couple can open a 529 plan with $150,000.

Money saved in a 529 plan grows tax-free when used for eligible educational expenses.

Note that you can contribute more than $15,000 in one year or $75,000 over five years. Any gifts above the annual exclusion amounts will have to be reported on the federal tax Form 709, and these will be counted against the lifetime exclusion (currently $11.4 million in 2019). If your gift exceed $11.4 million, you may owe gift taxes of up to 40%.

10. Determine your net worth

Add up what you own (home, car, savings, investments, French wine...) and subtract what you owe (mortgage, loans, credit cards, ...).

This will allow you to track your progress year to year. It may also give you some incentive to save more and create a better budget for next year.

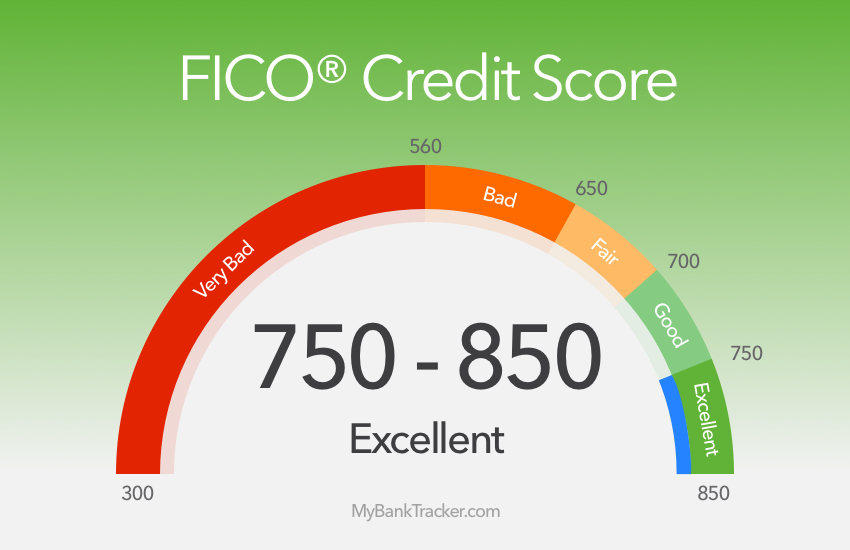

11. Check your credit score

Go to annualcreditreport.com and request a free credit report from each of the three nationwide credit reporting agencies. You're entitled to one free report from each agency every 12 months.

Monitor your credit score regularly (Cybersecurity-Equifax was breached) with companies with myfico.com. A service like lifelock.com may be useful too.

12. Check your beneficiaries

You can check the beneficiaries on your financial accounts or insurance policies at any time, but it's a good idea to do this at least annually.

13. Update your estate plan

New baby? Newly married or divorced? Make sure your beneficiary designations reflect any changes.

Don't yet have an estate plan? Make that a new year's resolution!

Estate planning may include updating or establishing a "will", a trust that can help avoid the costs and the public disclosure of assets in probate, a Power of Attorney...

14. Maximize your business deductions

You may want to increase your participation in passive activities since the rules prevent taxpayers from deducting losses from business activities in which they do not “materially participate.” To meet the material participation standard, there are some tests (e.g., spending more than 500 hours per year in day-to-day operations, performing substantially all the work in the activity, or completing more than 100 hours per year and more than anyone else). It may be very beneficial if you’re expecting a loss from your activity.

15. Spending and automated savings – You want to look ahead

Did you review your budget and set up automated savings?

You may have started the year with a clear budget, but did you tick to it?

Fall can be a good time of the year for your financial checkup and to reflect on your spending, and develop a budget for next year.

It is also a very good time to put whatever you can on automatic. Bills, recurring payments, even savings - the more you can put on auto pay now, the easier your financial life will be next year.

With this year's facts and figures in front of you, it will be easier to plan and prioritize your expenditures for next year.

Conclusion

Schedule a meeting with your financial planner who can help you segment and prioritize your personalized goals for 2020. Discuss major life events with your adviser, such as a marriages or divorces, births or deaths in the family, employment changes, and significant new expenses (real estate, college tuition, new car...).

You want to look ahead!

This letter is intended to give you a few ideas and a checklist to get you thinking about planning for a better 2019. Call us if you would like more details or would like to schedule a tax / financial planning strategy meeting.

This newsletter was first published in September of 2019

https://mailchi.mp/bourbonfm/15-financial-moves-to-make-before-the-end-of-the-year-1189681